hotel tax calculator illinois

Just enter the five-digit zip code of the. The tax is reported on Form RHM-1 Hotel Operators Occupation Tax Return.

States With Highest And Lowest Sales Tax Rates

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. In addition to the Citys hotel use tax the State of Illinois collects a 564 hotel tax. The City of Decaturs hotel use tax rate is 8. Hotel Tax Matrix City of Chicago HOTEL ROOM REVENUE Revenue Taxable Description Furnished By Hotels YN Tax Type Comments This matrix addresses only those City of Chicago taxes.

A monthly return is due on or before the last day. Ad Finding hotel tax by state then manually filing is time consuming. The tax is reported on Form RHM-1 Hotel Operators Occupation Tax Return.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The tax is locally administered.

Call us at 217 782-6045. Our calculator has recently been updated to include both the latest Federal Tax. RHM-1 Hotel Operators Occupation Tax.

Beer will generally be subject to a rate. Write us at Illinois Department of Revenue Miscellaneous Taxes Division PO. Hotel Operators Occupation Tax Return R-0513 NOTE.

The new form mirrors the 7520 tax return but the Tax and the Surcharge should be paid and reported separately beginning with the December 2018 payment due 11519. The due date is the same as provided for in. The document has moved here.

Ad Finding hotel tax by state then manually filing is time consuming. Illinoisans shouldered a record income tax increase in 2011 bringing the income tax rate to 5. But instead of increasing taxes on local residents property taxes for example state and local.

Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. If filing a tax period prior to April 2011 call 217 785 6606 to obtain the correct form. Convention hotels located within a.

Avalara automates lodging sales and use tax compliance for your hospitality business. Hotel tax calculator illinois. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate.

Call our TDD telecommunications device for the deaf at 1 800 544-5304. The following local taxes which the department collects may be imposed. Hotel Use Tax Forms Tax.

If imposed the preprinted rate on Form RHM-1 will include this tax. Illinois Alcohol and Tobacco Tax. Except as noted on their respective pages the preprinted rate on the return will include any locally imposed taxes.

Illinois lawmakers promised the tax hike would partially sunset in 2014 to. Avalara automates lodging sales and use tax compliance for your hospitality business. Illinois has a 625 statewide sales tax rate but also.

If imposed the preprinted rate on Form RHM-1 will include this tax. Illinois Department of Revenue Subject. So if the room costs 169 before tax at a rate of 0055 your hotel.

Hotel Operators Occupation Tax Return Keywords. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202122. 54 rows 3 State levied lodging tax varies.

The due date is the same as. RHM-1 - Hotel Operators Occupation Tax Return Author. Name Description MyTax Illinois.

Illinois applies per-gallon alcohol excise taxes based on the alcohol content of the beverage being sold.

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Sales Tax Guide And Calculator 2022 Taxjar

Here S How Much Money You Take Home From A 75 000 Salary

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Tax City Of Decatur Il

Law Firm Website Design Paperstreet Law Firm Website Law Firm Website Design Law Firm

2020 Illinois Trade In Sales Tax Law Change

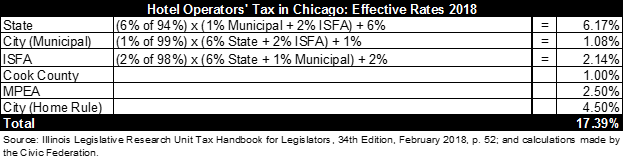

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Trip Cost Calculator Fleet Management

How To Charge Your Customers The Correct Sales Tax Rates

Property Tax City Of Decatur Il

Estimated Tax Payments For Independent Contractors A Complete Guide

Illinois Sales Tax Quick Reference Guide Avalara

Lake County Real Estate Tax Appeal Estate Tax Lake County Illinois

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers